The Importance of Ethical Considerations in the Use of AI Tools in Tax Administration

Introduction

The increasing use of artificial intelligence (AI) tools in tax administration has brought new risks that need to be carefully managed. According to Paul Marsh, an adviser to the Forum on Tax Administration (FTA) Secretariat at the Organisation for Economic Co-operation and Development (OECD), “Tax administrations really have to think about fairness and transparency in AI tools.” This article explores the ethical considerations surrounding the use of AI tools in tax administration and argues for the need for greater oversight to ensure public trust in the tax system.

The Risks of AI in Tax Administration

There are a range of risks associated with the use of AI tools in tax administration, from algorithms generating incorrect answers to a lack of transparency in decision making. The risk of errors in AI-generated tax assessments is a growing concern. These errors can lead to taxpayers being unfairly penalised or, on the other hand, escaping undetected having underpaid. This issue is becoming increasingly important as tax authorities are relying more and more on automated assessments to enforce compliance.

The Need for Transparency in Decision Making

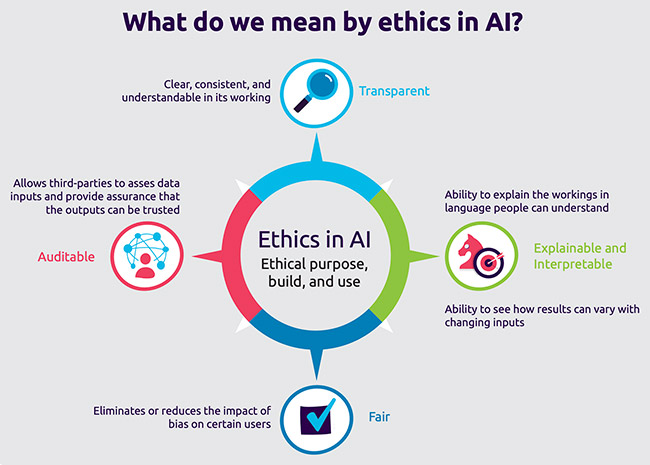

Another risk associated with the use of AI tools in tax administration is the lack of transparency in decision making. The use of AI can produce complex algorithms that make it challenging to understand how a particular tax assessment was reached. This lack of transparency can lead to questions over the legitimacy of tax assessments and a lack of trust in the tax system. Therefore, it is important that tax administrations implement measures to ensure that their use of AI tools remains transparent.

Ensuring Fairness in AI Tools

Ensuring fairness in the use of AI tools is another crucial ethical consideration for tax administrations. AI systems are programmed based on historical data, which can result in biases being built into the algorithm. This means that certain groups of taxpayers may be more likely to be unfairly targeted. To prevent this, tax administrations must ensure that they are continually reviewing their AI systems for potential biases and taking steps to eliminate them.

The Need for Oversight

Governments and tax authorities must be proactive in their efforts to manage and monitor the use of AI tools in tax administration. The FTA is leading a project investigating ethical considerations surrounding AI in tax administration, with the participation of 24 tax authorities. However, greater oversight is still needed to ensure that AI tools are used in a way that avoids unfairly targeting certain groups of taxpayers and maintains public trust in the tax system. Stakeholders including the general public and the tax-paying public must be involved in discussions on the ethical implications of using AI tools in tax administration.

Conclusion

The increased used of AI tools in tax administration brings significant risks. Tax administrations must take steps to ensure that their use of AI remains transparent, unbiased, and fair, and is subjected to greater oversight. This is necessary to preserve trust in the tax system, avoid unfairly targeting certain groups of taxpayers, and prevent public resistance to the efficiency gains promised by AI.

Long-tail Keywords:

- AI tools in tax administration

- Ethical considerations in AI in tax administration

- Transparency in decision making in tax administration

- Fairness in AI tools for tax administration

- Oversight in AI tools for tax administration

Originally Post From https://news.bloombergtax.com/financial-accounting/tax-officials-scrutinizing-ethical-transparency-risks-in-ai-use

Read more about this topic at

The three challenges of AI regulation

An Oversight Model for AI in National Security: The Privacy …